PensionDanmark invests members' savings in age-based pools, where the investment risk is adjusted according to the members' age and expected time to retirement.

For younger members, savings are invested in pools with a significant short-term investment risk in order to generate an attractive long-term return. Once an individual member reaches the age of 51, a gradual reduction of investment risk is initiated leading up to the retirement age.

PensionDanmark's investment strategy is predicated on the expectation that publicly traded equities are the liquid asset class that, over a longer horizon, can be expected to yield the highest return. However, we also know from experience that the publicly traded equity markets are very sensitive to economic developments, and therefore share prices can fluctuate considerably in the short term. Publicly traded equities are thus most suitable for younger members, who have many years before retirement and therefore ample time to recover from temporary setbacks in the stock markets.

To create a more robust portfolio with reasonable risk diversification, we combine investments in the publicly traded equity and bond markets with unlisted investments.

For younger members, where unlisted investments primarily take the place of fewer publicly traded equities, the focus is mainly on infrastructure and renewable energy projects, Private Equity and venture funds, as well as various types of unlisted lending, where we have a strong conviction that we can generate returns that, measured over a slightly longer period, can at least match the returns in the publicly traded stock markets.

For older members, where unlisted investments more often replace investments in Danish government and mortgage bonds, a larger portion of the unlisted investments consists of Danish office and residential properties, as well as various types of unlisted lending, etc.

The table below outlines the initial asset allocation for the age-based pools in 2025.

Benchmark for the Age-Based Pools' Asset Allocation

| Asset Classes | Age 50 2025 |

Age 60 2025 |

Age 67 2025 |

Age 75 2025 |

| Listed Equities | 54,5 | 40,0 | 21,5 | 11,5 |

| Private Equity | 12,5 | 9,0 | 4,5 | 2,5 |

| Equities in total | 67,0 | 49,0 | 26,0 | 14,0 |

| Listed Credit Bonds | 9,5 | 14,5 | 19,0 | 15,0 |

| Private Debt and Credit Funds | 4,5 | 4,5 | 4,0 | 4,0 |

| Credit Investments in total | 14,0 | 19,0 | 23,0 | 19,0 |

| Real Estate | 5,5 | 12,0 | 14,0 | 14,0 |

| Infrastructure | 7,0 | 9,0 | 12,5 | 12,5 |

| Stable Alternatives in total | 12,5 | 21,0 | 26,5 | 26,5 |

| Danish government and mortgage bonds | 6,5 | 11,0 | 24,5 | 40,5 |

| Total | 100,0 | 100,0 | 100,0 | 100,0 |

It shows that for members up to the age of 50, publicly traded equities and Private Equity funds typically constitute about two-thirds of the investments. A combination of unlisted investments and various types of bonds make up the remaining third of the investments.

For members over the age of 50, the equity portion is gradually reduced, and instead, investments are increased in other asset classes that have a more stable and predictable return.

To ensure pensions keep pace with wage developments, the composition and risk profile of the age-based pools reflect a goal of achieving a real return on investments that, over the course of saving, matches the development of real wages and at a minimum provides a real return of 2 percent. To achieve this, we must be willing to accept significant fluctuations in members' returns from year to year.

In addition to equities, investments in stable alternatives (infrastructure and real estate) constitute a significant part of the investment assets. Investments in stable alternatives create a good balance in the portfolio and often have a stabilizing effect in years when equities are struggling. They also provide good protection against rising inflation and thus contribute to the ambition of achieving an attractive real return.

High and Low Risk

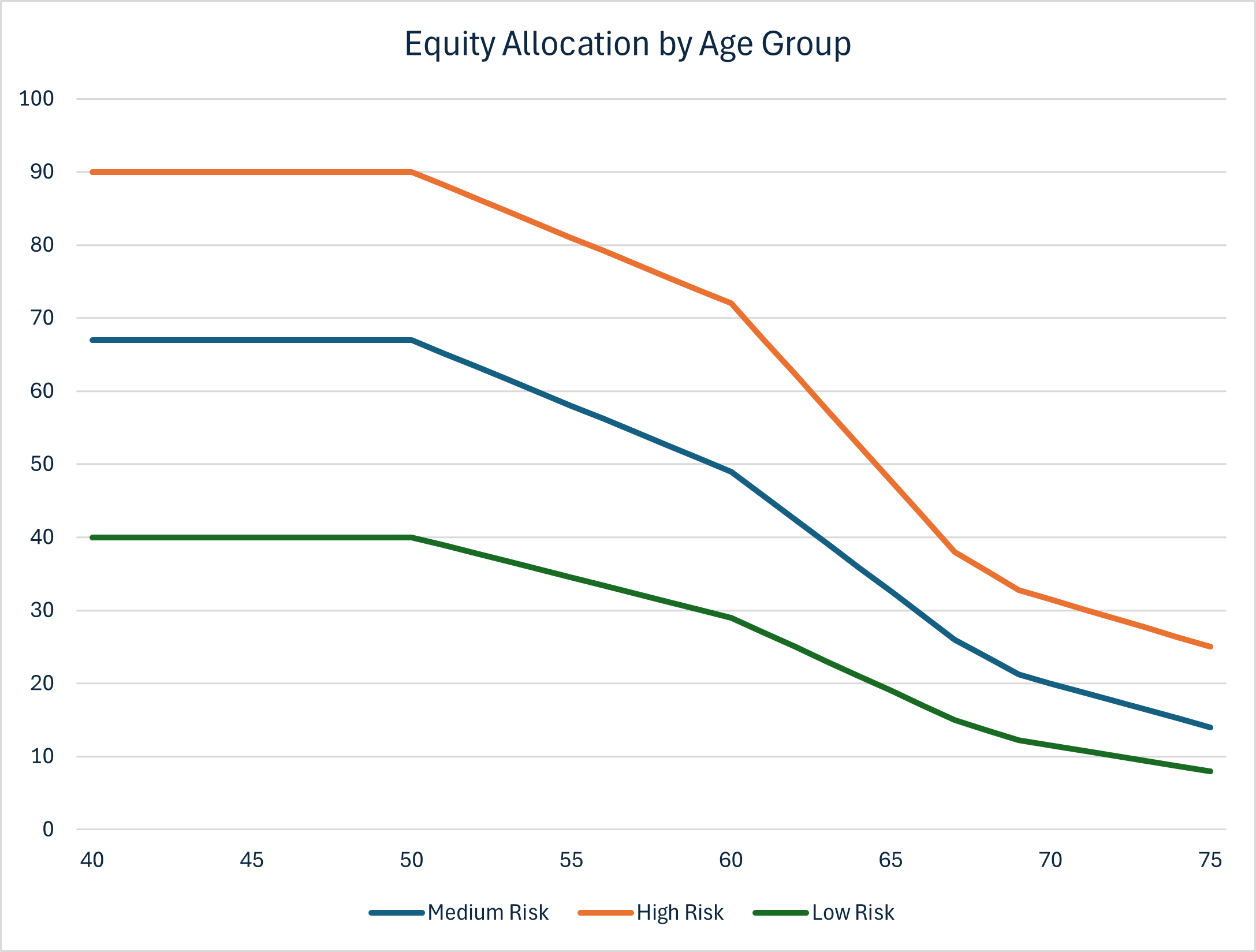

Members who prefer a different risk profile can choose between high risk and low risk, which respectively have more and fewer equities than PensionDanmark's standard product (medium risk). The figure shows the proportion of stocks in the investments for each age group.

Adjustment of the Investment Strategy for 2025

The investment strategy for 2025 has been adjusted compared to 2024. The timing for when the tapering off of investment risk begins has been extended by 5 years, so the gradual reduction now starts from age 51 instead of the earlier age of 46.

At the same time, the equity share has been increased for all ages compared to 2024. The equity share for younger members has been raised by 7 percentage points to 67%, and the equity share for a 67-year-old has been increased from 24% to 26%.

Free Choice of Investment Pool

Members who wish to determine the composition of the investments in their pension plan can use PensionDanmark's Free Choice of Investment Pool. Here, they can decide for themselves the distribution between equities and bonds and choose between different types of investment funds.

Risk Figures

For market rate products, there is an industry standard for assessing risk expressed by a risk figure that ranges between 1 and 5.9. At faktaompension.dk/risiko, one can view PensionDanmark's risk figures for each age and compare the risk figure with the industry average for the risk profiles medium, low, and high risk.

Payout Profile

PensionDanmark aims to ensure that there is good stability in the members' pension payouts and that there is a good possibility of maintaining the purchasing power of the benefits as far as possible throughout the payout period.øbet.

For the portion of the pension benefits that constitute the lifelong annuity, PensionDanmark's smoothing mechanism is used, which aims to create stable, real payouts.