In 2017, the financial markets were characterized by a broadly founded, global economic recovery with high growth in almost all regions. The positive development is reflected by falling unemployment and increased profitability in many companies.

As a result, all age groups in PensionDanmark has achieved good investment returns. 9.9 percent for members under the age of 41 investing with a higher share of equity and risk profile than older members. The investment return for members at the age of 65 was 6.9 percent.

“Investments in equity were benefitting of the positive development in the global economy. The listed equities contributed with the highest investment return, 13.0 percent. Investments in private equity, real estate and infrastructure had investment returns of 10.0 percent, 9.5 percent and 12.8 percent. Thereby investments in these assets contributed to the high investment return,” says CEO in PensionDanmark, Torben Möger Pedersen and continues:

“The investment return on infrastructure is among other things due to good returns on funds managed by Copenhagen Infrastructure Partners (CIP), who takes care of the majority of PensionDanmarks investments in renewable energy assets.”

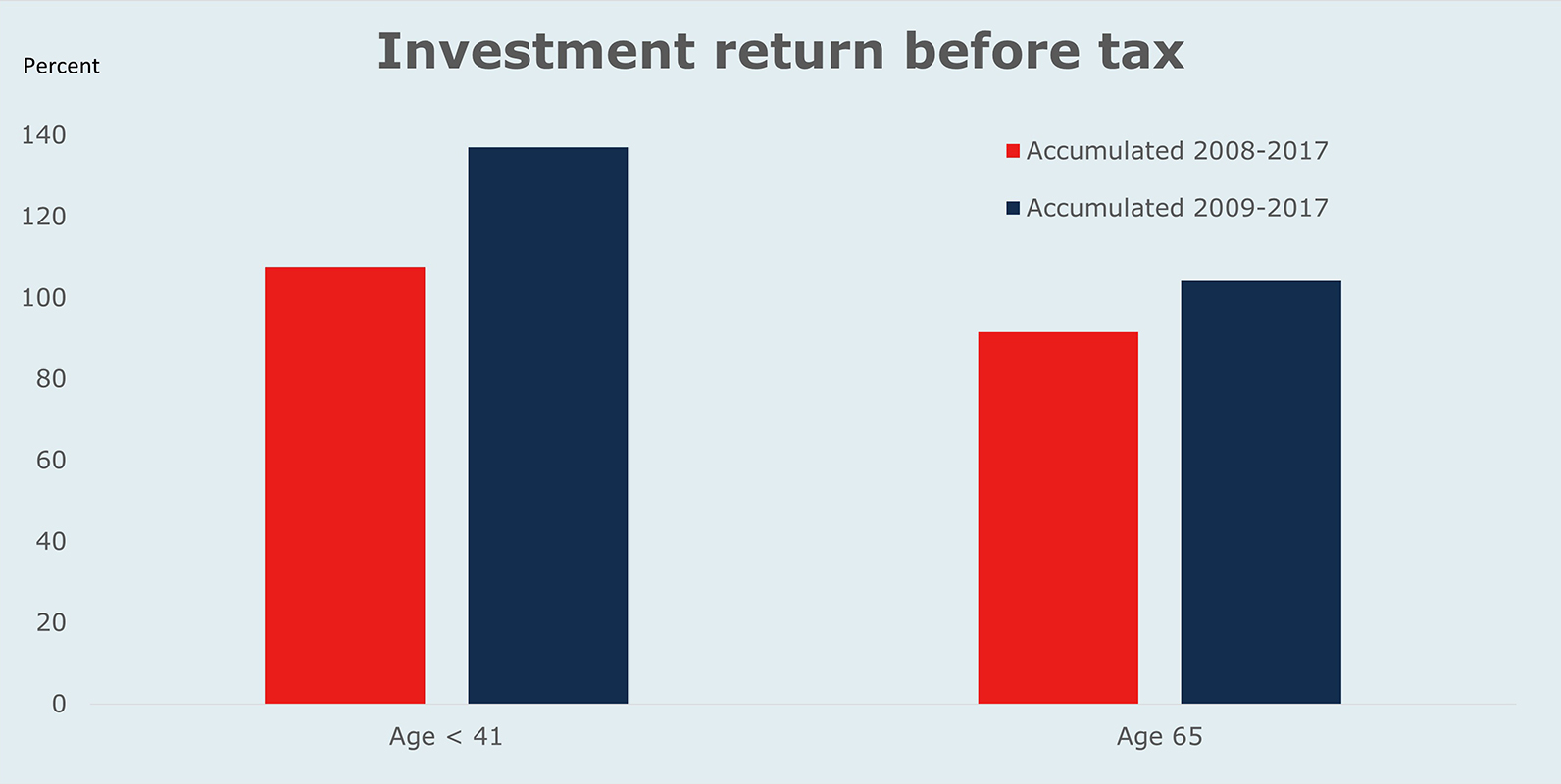

Since the financial crisis, PensionDanmarks age groups has achieved high and relatively stable investment returns. Including the losses in 2008, the age groups for both older and younger members in PensionDanmark in average have had a yearly investment return between 6.7 and 7.6 percent during the last ten years. Through the years 2009 to 2017, the yearly investment return in average has been between 8.3 and 10.1 percent.