Despite the global COVID-19 pandemic, PensionDanmark delivered solid returns in 2020 for the benefit of our members.The losses sustained in the spring when equity markets plummeted were recouped and more, giving PensionDanmark’s members a total investment return of DKK 16.1 billion.

“We delivered highly satisfactory results in a challenging year. We are robustly positioned thanks to our highly diversified investment portfolio and its strategic bias towards infrastructure and sustainable real estate. This provides stability if equity markets face headwinds,” says Torben Möger Pedersen, CEO of PensionDanmark.

Although the Danish economy suffered a major setback, staff numbers at most of the companies that are members of PensionDanmark remained relatively high and stable, so the number of active members was largely unchanged.

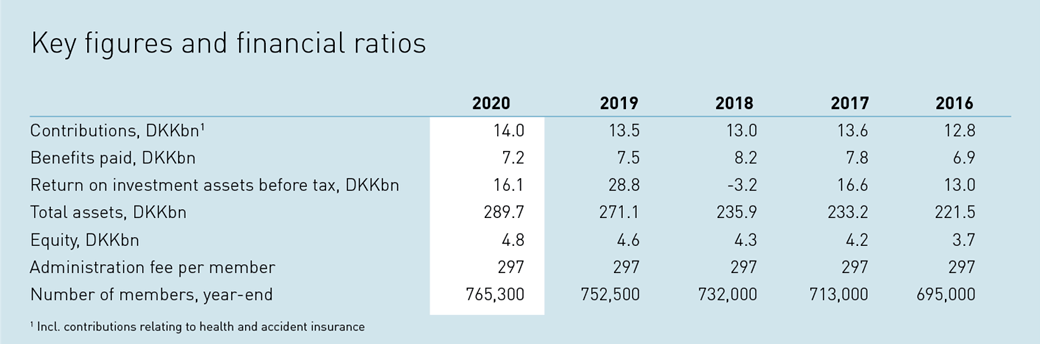

Total contributions increased to DKK 14 billion in 2020 from DKK 13.5 billion in 2019, while total assets grew by almost 7% to DKK 289.7 billion.

Innovation translates into higher customer satisfaction

When contributions grow, so do the savings of PensionDanmark’s members given that PensionDanmark is Denmark’s most cost-effective pension fund.

Investment costs remain among the very lowest in the industry, and annual administrative expenses were kept unchanged at DKK 297 per member once again. This is possible not least because of extensive use of new intelligent technologies for member services and case processing.

“This allows for faster case processing, better resource utilisation and more time for personal advice and dialogue with our members – which not only helps ensure that our members’ pension contributions are primarily used to increase their savings, but is also reflected in impressive member satisfaction scores,” says Möger Pedersen.

Raising the bar for ethics and responsibility

PensionDanmark’s innovative use of member data also calls for strong and, not least, transparent data ethics. For this reason, PensionDanmark has chosen to account for its data ethics policy from 2020, although we are not legally required to do so until 2021.

In 2020, we also stepped up our efforts on responsibility and sustainability. This is reflected in the annual report, which includes both additional ratios and 2025 targets for PensionDanmark’s ESG (Environmental, Social and Governance) work.

“We are raising the bar and disclosing additional information on our corporate social responsibility efforts in order to increasingly give our members a financially secure retirement through a sustainable approach,” Möger Pedersen adds.

In addition to gender equality data etc., the 2020 annual report also contains new climate data documenting PensionDanmark’s progress on reducing the climate impact of its investments and own CO2 emissions.

FACTS:Selected ESG ratios

Diversity

At end-2020, 44.3% of PensionDanmark’s managers were women. In 2016, the share was 33.0%. The proportion of female managers now exceeds the proportion of women in the organisation as a whole (43.7%). The target is a female proportion – of managers and staff in general – of 50% by 2025.

Climate impact

The carbon footprint of PensionDanmark’s total investments was reduced by 16% to 6.6 tonnes/DKKm in 2020 from 7.9 tonnes/DKKm in 2019. The renewable energy share of PensionDanmark’s own energy consumption increased by almost 5pp to 78.2% – more than twice the proportion in 2016 (35.8%).

Job satisfaction

The staff turnover rate fell by almost 3.7pp to 12.0%. In 2016, the rate was 20.8%. In the same period, the average number of sickness absence days per full-time employee has fallen by almost 50% from 9.1 days in 2016 to 4.7 days in 2020. Our target is to reduce average absence to 4.5 days by 2025.

Watch Toben Möger Pedersen elaborate on annual report (YouTube)